This post may contain affiliate links. When you purchase a product using my affiliate link, I may receive a small commission (at zero cost to you). Know that I only recommend products I know and trust.

Do you have a business idea that you’re passionate about but unsure where to begin? No worries, we got you. Whether you’re starting a blog, online store, or creative business, we’ll cover the essential steps you need to take to get started.

First, we want to say congrats! We’re thrilled that you’ve decided to boldly go after your dream and create the life you desire. Starting your own business, working towards financial independence, and investing in yourself is no small feat. So, we would like to give you the tools needed to position you for success from the start.

This post will walk you through how to start a business successfully. It may seem overwhelming initially, but take one step at a time, and you’ll be on your way to your new future in no time. Grab a cup of coffee or tea, and let’s get this party started.

I know, doing research doesn’t sound like the party I mentioned earlier, lol. But to be successful, research is critical when starting a business. Market research will help you gather information about potential customers and businesses already operating in your industry or niche. This information can be used to find a competitive advantage for your business.

For a small business to be successful, it must solve a problem, fulfill a need, or offer something the market wants. Research helps you identify this need and who needs it, explore the strengths and weaknesses of companies offering similar products and services, and look for gaps or unique offerings that can make your business stand out.

A good business plan guides you through each stage of starting and managing your business. To be honest, this step was the one I struggled with the most because it felt a bit overwhelming. The key is to spend some time working through it step by step. Creating a business plan forced me to think through all the key elements of my business.

The good news is that there are different types of business plans. You can choose the one that works best for the kind of business you’re creating.

A traditional business plan is necessary if you intend to seek financial support from an investor or a bank. This kind of business plan is generally long and thorough and has a standard set of sections that investors and banks look for when validating your idea.

If you don’t need investors or a loan, a simple business plan is all you need. At the end of the day, the goal is to ensure that you get clear on what you hope to achieve and how you plan to do it.

Let’s talk money for a second. You don’t necessarily need much money to start a small business. Still, it will involve some initial investment and the ability to cover ongoing expenses before you start making a profit. Focus only on the essential things you need. You can grow your business in small increments. Don’t go wild, spend all your money on things you don’t need, and put yourself in unnecessary debt.

Plan your business finances and manage them wisely. Create a spreadsheet and write down your start-up costs (business registration fee, licenses, permits, etc.) and what you need to keep your business running for at least one year (rent, utilities, marketing, etc.). If you don’t have that amount, you’ll need to raise or borrow the capital.

According to the U.S. Small Business Association, there are several ways you can fund your small business, including:

The legal structure you choose for your business will impact your business registration requirements, how much you pay in taxes, and your personal liability. Your safest bet is forming a Limited Liability Company (LLC) for a small business or entrepreneur. An LLC protects your personal assets should something go wrong in the business. To better understand the different types of business structures, we will explore them briefly.

There are four common types of business structures:

Let’s talk through the pros and cons of each.

A sole proprietorship is a business that’s owned and run by one person, where the government makes no legal distinction between the person who owns the business and the business itself. You’re automatically considered a sole proprietorship if you conduct business activities but don’t register as any other kind of business.

Pros: It’s easy to form, and you have complete control of your business. Tax preparation is simple since a sole proprietorship is not taxed separately from its owner.

Cons: Since the owner and the business are legally the same, the owner is personally liable for all the business’s debts and obligations. It can also be more challenging to raise money since banks are hesitant to lend to sole proprietorships.

According to the U.S Small Business Association, Sole proprietorships can be the right choice for low-risk businesses and owners who want to test their business idea before forming a more formal company.

A partnership is a single business where two or more people share ownership, and each owner contributes to all aspects of the company and shares in the profits and losses of the business.

Pros: It’s pretty easy and inexpensive to form a partnership. When two or more people are invested in a business, you can pool resources and benefit from each other’s skills and expertise.

Cons: Like a sole proprietor, partners have full, shared liability if the business goes south. In a partnership, you are responsible for your actions and the actions of your partner(s). You can protect against this if you form a limited liability partnership. Also, whenever you have two or more people making decisions, there are bound to be disagreements. Ensure that you document how decisions will be made in the company and how profits will be shared, especially if things go sideways.

A limited liability company (LLC) offers the personal liability protection of a corporation with the pass-through taxation of a sole proprietorship or partnership. LLCs can be owned by one or more people, who are known as LLC “members.”

Pros: Forming an LLC allows you to protect your personal assets if your business gets sued. It’s the most popular choice for entrepreneurs and small businesses for this reason.

According to TRUIC, an LLC’s profits go directly to its owners, who then report their share of the profits on their individual tax returns. Hence, LLC’s profits are only taxed once. This is known as pass-through taxation.

Cons: LLC owners are responsible for paying taxes on their share of LLC income, whether or not they are given a disbursement.

A corporation is a legal entity that is separate and distinct from its owners and has most of the rights and responsibilities that an individual possesses. Corporations can enter into contracts, loan and borrow money, sue and be sued, hire employees, own assets, and pay taxes. Corporations are more complex than other business structures and are usually for larger, established companies with multiple employees.

Pros: Getting loans or investments is usually easier for corporations. Similar to an LLC, corporations also provide the best protection for personal assets. Shareholders may take part in the profits through dividends and stock appreciation but are not personally liable for the company’s debts.

Cons: Corporations are more complex and have more costly administrative fees and more complicated tax and legal requirements.

To better understand each business structure, check out the U.S Small Business Administration’s Choose a Business Structure Guide.

Okay, whew! That was a lot to take in. Take a deep breath, inhale, and exhale. Alright, let’s continue.

Choosing the right name for your business isn’t always easy, but with a little creativity and market research, you’ll be able to find the perfect name that fits your brand. Once you’ve selected the name you love, make sure that the name is available.

You can find out if your desired business name is available by following a few simple steps:

If you’ve done all your research and your desired name is available, go ahead and grab the domain and all the social media handles. You can purchase a domain name with Bluehost, NameCheap, or Google Domains. I usually get the .com, .net, and .info extensions of the domain I desire.

If you can, you should also trademark your business name. A trademark protects words, names, symbols, and logos that distinguish goods and services. Filing for a trademark costs less than $300, and you can learn how to do it here.

Once you’ve identified your business name and conducted your research, you should register your business. Your business location and structure will determine how you’ll need to register your business. If you don’t register your business, you could miss out on personal liability protection, legal benefits, and tax benefits.

For most small businesses, registering your business is as simple as filing your business name with state and local governments. As mentioned earlier, I would go with the option of registering your business as an LLC. But as always, do your research on what would work best for you.

To find more information on doing business in your state, you can view the list of state government websites that walk you through what you need to set up a business in your state.

Your state tax ID and federal tax ID numbers — also known as an Employer Identification Number (EIN) — work as a personal social security number, but for your business. You need it to pay federal taxes, hire employees, open a bank account, and apply for business licenses and permits. Applying for an EIN is free, and you should do it right after you register your business.

Keep your business running smoothly by staying legally compliant. The licenses and permits you need for your business will vary by industry, state, location, and other factors.

You’ll need to get a federal license or permit if your business activities are regulated by a federal agency. Check to see if any of your business activities are listed here, and then check with the right federal agency to see how to apply.

It’s best practice to keep your business and personal funds separate. Depending on your business structure, you may be required to have a business account. A small business account is easy to set up and will help you handle legal, tax, and day-to-day expenses.

Some documentation you will need to bring to the bank to open a small business account includes the following:

You can check with your bank to see what types of small business account options they offer. Rates, fees, and benefits vary from bank to bank, so shop around and select the best option.

If you plan to accept payments online, you can sign up for a PayPal or Stripe business account. Both options allow you to accept debit/credit card payments online and will enable you to transfer funds to your business bank account.

Setting up your place of business is one of the most important decisions you’ll make. Whether you’re setting up a home office, a shared or private office space, or a retail location, ensure you have a designated area where you can focus and get work done.

Once you’ve got all the legal stuff out the way, you can begin building your small business’s core marketing elements, including your website, blog, email tool, and social media accounts.

Getting a domain name is one of the most important steps to establishing a presence on the internet. A domain name is your unique address on the web, and it’s how people will find you. For example, www.yourdomain.com. It’s also how you can create an email address that looks professional, like jane@yourdomain.com. Having a domain name also helps to establish credibility, as it shows that you’re serious about your business or website. It also allows you to have a website that is easily recognizable to customers or visitors.

To get a domain, you’ll need a domain name registrar. I personally use Google Domains and Namecheap, but there are so many options online to choose from.

Website hosting is an essential part of having an online presence. Without a host, your website won’t be accessible to the public. Website hosting provides access to the server space necessary to store and deliver your website content, such as images, text, and videos. It also provides a secure connection to the server, which is necessary for a website to be secure and reliable. The hosting provider also provides tools and services to make managing and maintaining your websites easier, such as automatic backups and software updates.

If you’re looking for a reliable and affordable WordPress website hosting solution, Bluehost would be a great option for you.

Once you have your domain name and website hosting, you’ll need to create a website. Creating a website is essential to starting a new business in today’s digital world. It’s a great way to showcase your products and services to the public, build brand awareness, and attract customers. It also provides a platform to gain valuable insights into customer behavior, automate marketing and customer service tasks, and create a professional and credible online presence. Having a website is an easy and cost-effective way to reach potential customers, so it’s a no-brainer for any business looking to expand and succeed in the digital age.

The most popular platforms for entrepreneurs to create a website are:

Related article: How to make your own website

Business emails provide a professional and reliable way to communicate with colleagues and customers and can be used to build trust and maintain relationships. To set up your business email, check out Google Workspace. This allows you to set up a custom email, share files securely online, video chat from any device, and more.

In order to expand your reach, generate interest in your brand, and stay in touch with your target audience, it is essential to establish an active presence on a social media platform that is tailored to your business. By creating business profiles on social media, you can reach out to potential and current customers, helping to build your brand and strengthen relationships with them.

Building an email list is an important step in the success of any business or organization. An email list allows you to communicate directly with a group of people who have already expressed interest in your product or service. You can send personalized messages, offer discounts, promote new products and services, and build relationships with new and existing customers.

You’ll need an email marketing service provider to start building your email list. Two of the most popular ones for creative entrepreneurs are ConvertKit (14-day free trial) and Flodesk (use this link to get 50% off your first year).

Starting your own business is usually filled with passion and excitement but sometimes can be overwhelming. Having a supportive community you can go to for advice, encouragement, and inspiration is good. As a business owner, you won’t always know the answer, but someone who has been where you are and has made it through to the other side will be able to help you along the way.

You can find an online community through various Facebook groups related to your niche or by reaching out to someone who successfully does what you would like to do and ask them if they would be your mentor.

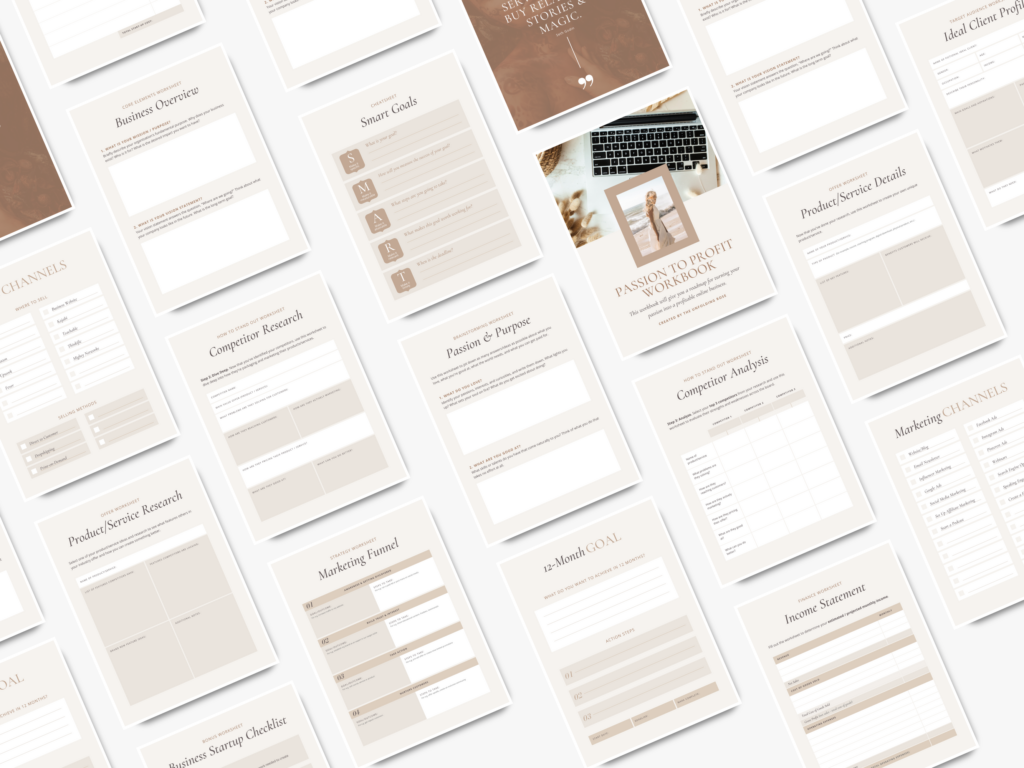

Click on the button below to learn more about our Passion to Profit Workbook.

This business planning system will give you a roadmap for turning your passion into a profitable online business.

Once you’ve completed these 12 steps to start your business, you will have covered the most important bases. Remember to take it one step at a time. Give yourself time to think through carefully what you would like to create, who you would like to build it for, and how their lives will be impacted by the services or products you offer. Throughout this process, also remember to be patient with yourself.

You can do this! No one is you, and that is your superpower.

I look forward to the beauty you’ll create in this world.

I love, honor, and appreciate you.

Thanks for reading!

Disclaimer: This article is not meant to be taken as professional legal or financial advice. I am not a tax or legal professional and am not liable for misinformation or missing information in the above article. Please contact an accountant, financial advisor, or lawyer for financial and legal advice.